Text Version

How Will Hong Kong’s Proposed New Digital Asset Licensing Regime Affect the Industry?

Legislative Proposal to Regulate “Virtual Asset Service Providers”

In June, 2022, the government proposed legislation to regulate virtual asset service providers (“VASPs”) and to combat fraud and deceptive practices in transactions of “virtual assets”.

New Legislation Works Alongside Existing Securities Legislation

Proposed new legislation will fill gaps in regulation as digital assets may fall outside existing securities and futures laws. Together, the new law and existing laws will provide greater regulatory coverage of the industry.

Players in Digital Asset Industry Will Need to Assess Which Regime Applies

Existing laws regulate “securities” and “futures contracts”. Digital assets in the form of “securities” can be created or adopted to opt-into existing regulation. Proposed new law will regulate “virtual assets” including digital assets that constitute neither “securities” nor “futures contracts”.

Existing Securities Regime and New Regime Expected to be Consistent

Any VASP already licensed under the opt-in regime will be exempted from the new VASP licensing requirement. Regulation under the opt-in regime and the proposed new licensing regime are intended to be consistent with both administered by the Securities and Futures Commission (“SFC”).

Expansion of Regulatory Coverage Will Limit Retail Activity

Consistency of regulation under new VASP licensing regime and existing opt-in securities regime suggests little room for dealing with investors other than professional investors where either regime applies.

Scope of Securities Regulation for Digital Assets

Existing securities regime covers:

- Typical securities

- Regulated investment agreements

- Other structured products

Definition of “Securities”

“Securities” includes shares or debentures; rights, options or warrants in respect of any share or debenture; interests in collective investment scheme; other interests commonly known as securities

Regulated Investment Agreements

“Securities” may include an agreement the (actual or pretended) purpose or effect of which is to provide (conditionally or unconditionally) to any party a profit or other returns calculated by reference to changes in the value of any property

Structured Products

“Securities” may include instruments under which some or all of the return or the method of settlement is determined by reference to:

- changes in the price, value or level of any securities, commodity, index, property, interest rate, currency exchange rate or futures contracts, or

- the (non-)occurrence of any specified event(s) (other than those relating only to the issuer/guarantor)

Scope of Virtual Asset Regulation

Virtual asset regulation will apply to “virtual assets”, meaning assets which meet 3 criteria:

- Unit of Account or Store of Value

- Electronic Dealing

- Medium of Exchange or Voting Rights

What Constitutes a Unit of Account or Store of Value?

A unit of account or store of value should meet the following criteria:

- Cryptographically secure

- Digital representation of value

- Expressed as a unit of account or a store of economic value

What Constitutes Electronic Dealing?

A virtual asset must be able to be transferred, stored or traded electronically.

What Constitutes a Medium of Exchange

A virtual asset is a medium of exchange if it functions (or is intended to function) as a means accepted by the public for the payment for goods or services or for the discharge of a debt, or for investment purposes.

What Constitutes Voting Rights?

A virtual asset has voting rights if it offers a vote on the management, administration or governance of the affairs in connection with, or a vote on any change of the terms of any arrangement applicable to, any cryptographically secured digital representation of value.

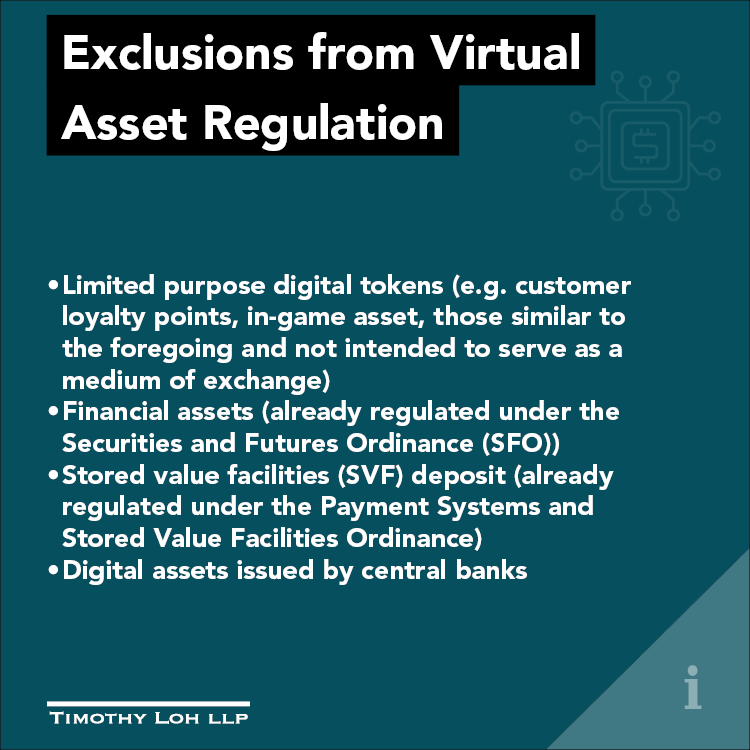

Exclusions from Virtual Asset Regulation

- Limited purpose digital tokens (e.g. customer loyalty points, in-game asset, those similar to the foregoing and not intended to serve as a medium of exchange)

- Financial assets (already regulated under the Securities and Futures Ordinance (SFO))

- Stored value facilities (SVF) deposit (already regulated under the Payment Systems and Stored Value Facilities Ordinance)

- Digital assets issued by central banks

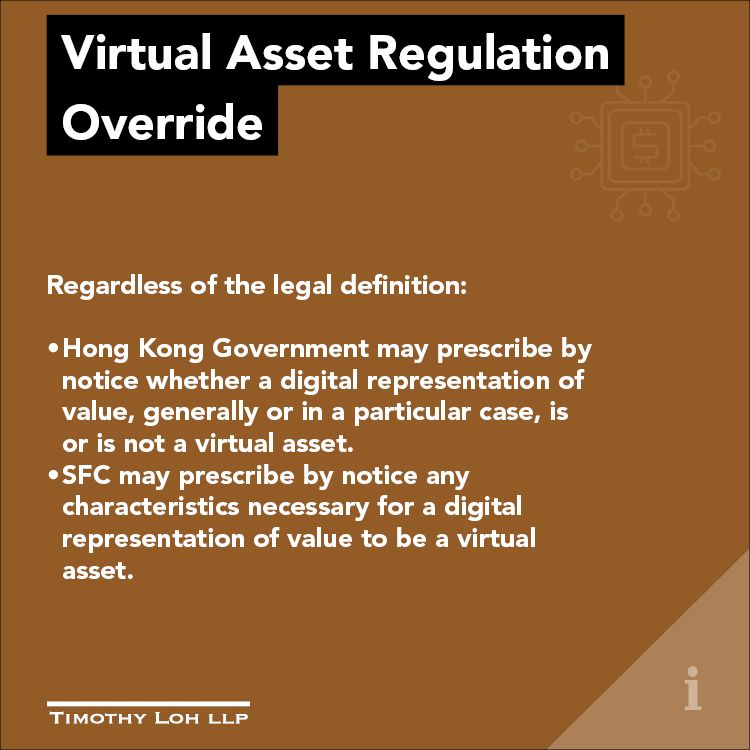

Virtual Asset Regulation Override

Regardless of the legal definition

- Hong Kong Government may prescribe by notice whether a digital representation of value, generally or in a particular case, is or is not a virtual asset.

- SFC may prescribe by notice any characteristics necessary for a digital representation of value to be a virtual asset.

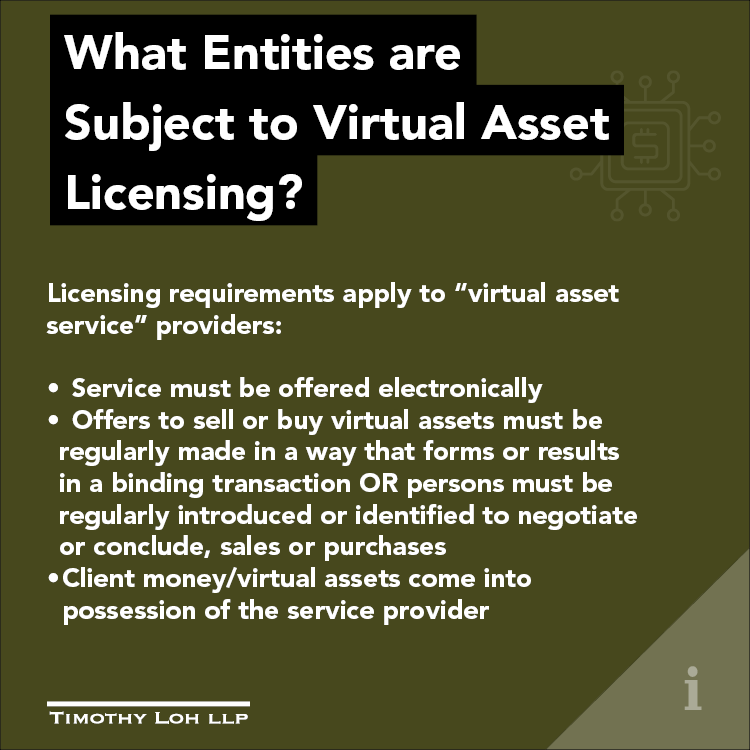

- Service must be offered electronically

- Offers to sell or buy virtual assets must be regularly made in a way that forms or results in a binding transaction OR persons must be regularly introduced or identified to negotiate or conclude, sales or purchases

- Client money/virtual assets come into possession of the service provider

What Entities are Subject to Virtual Asset Licensing?

Licensing requirements apply to “virtual asset service” providers:

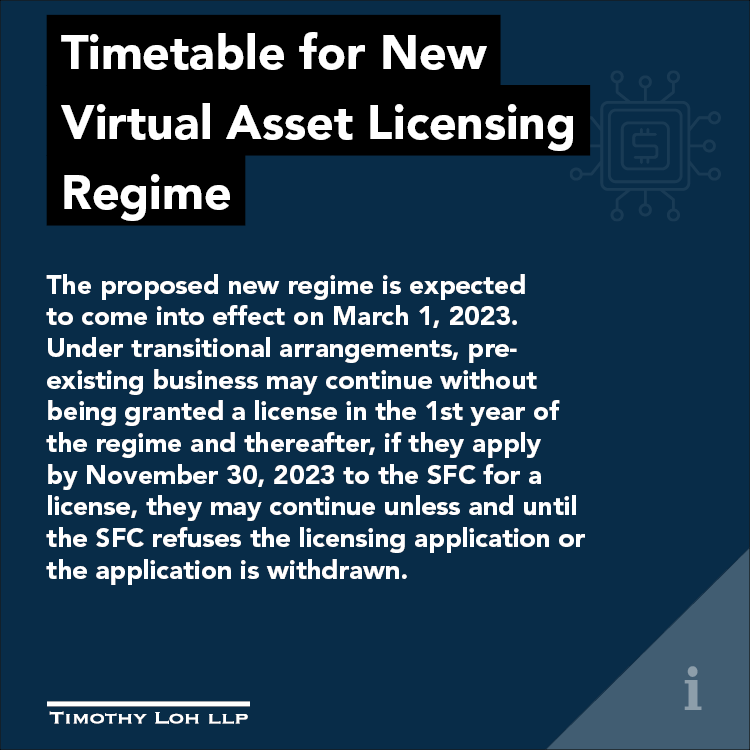

Timetable for New Virtual Asset Licensing Regime

The proposed new regime is expected to come into effect on March 1, 2023. Under transitional arrangements, pre-existing business may continue without being granted a license in the 1st year of the regime and thereafter, if they apply by November 30, 2023 to the SFC for a license, they may continue unless and until the SFC refuses the licensing application or the application is withdrawn.

Anti-fraud Offences

Mirroring securities legislation, the proposed new legislation will create an offence for fraudulently or recklessly inducing others to invest in virtual assets and an offence for use of fraudulent or deceptive devices in transactions in virtual assets